Discover Reliable Car Loan Providers for All Your Financial Requirements

In browsing the huge landscape of financial solutions, finding reliable finance companies that cater to your certain needs can be a difficult job. Let's discover some vital factors to take into consideration when looking for out financing services that are not just trustworthy however also tailored to fulfill your special monetary demands.

Kinds of Personal Loans

When thinking about personal fundings, individuals can choose from numerous types tailored to meet their certain economic demands. For individuals looking to settle high-interest debts, a financial debt combination funding is a viable choice. Furthermore, people in need of funds for home improvements or significant acquisitions might opt for a home improvement car loan.

Benefits of Online Lenders

Comprehending Lending Institution Options

Discovering the varied range of cooperative credit union alternatives can provide individuals with a valuable option when looking for financial solutions. Lending institution are not-for-profit financial cooperatives that supply a range of product or services similar to those of banks, including financial savings and checking accounts, car loans, debt cards, and a lot more. One crucial difference is that cooperative credit union are possessed and operated by their participants, who are also consumers of the establishment. This possession structure often translates into lower fees, competitive rates of interest on fundings and financial savings accounts, and a strong emphasis on customer care.

Lending institution can be attracting individuals seeking a more individualized approach to financial, as they usually focus on member contentment over earnings. In addition, credit report unions typically have a strong area visibility and might provide monetary education sources to aid participants improve their financial literacy. By recognizing the alternatives readily available at cooperative credit union, individuals can make educated decisions regarding mca loan companies where to leave their economic requirements.

Exploring Peer-to-Peer Financing

One of the key tourist attractions of peer-to-peer lending is the potential for reduced passion prices contrasted to traditional monetary institutions, making it an enticing choice for customers. Additionally, the application process for getting a peer-to-peer financing is normally streamlined and can result in faster access to funds.

Financiers likewise profit from peer-to-peer loaning by possibly gaining higher returns compared to conventional investment alternatives. By cutting out the middleman, investors can directly fund borrowers and receive a section of the interest payments. It's vital to note that like any financial investment, peer-to-peer borrowing carries intrinsic threats, such as the possibility of borrowers defaulting on their finances.

Federal Government Help Programs

Amidst the developing landscape of monetary services, an important element to take into consideration is the world of Federal government Help Programs. These programs play an essential duty in providing economic help and assistance to individuals and businesses during times of requirement. From welfare to tiny company financings, government aid programs intend to reduce monetary problems and promote economic security.

One prominent instance of a federal government assistance program is the Local business Management (SBA) finances. These car loans offer beneficial terms and low-interest rates to aid local business expand and navigate obstacles - quick mca funding. Additionally, programs like the Supplemental Nutrition Help Program (SNAP) and Temporary Assistance for Needy Families (TANF) give vital assistance for people and family members encountering economic difficulty

Additionally, entitlement program programs expand past financial assistance, including housing support, health care subsidies, and educational gives. These initiatives intend to attend to systemic inequalities, advertise social well-being, and ensure that all citizens have access to basic requirements and possibilities for improvement. By leveraging federal government assistance programs, people and businesses can weather financial tornados and aim in the direction of a much more protected financial future.

Conclusion

Jonathan Taylor Thomas Then & Now!

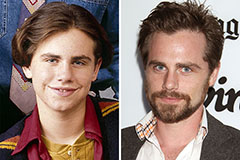

Jonathan Taylor Thomas Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now!